FHFA announced the new conventional loan limits in Colorado for 2022 in late November 2021. Dating back to early October, It was widely believed by mortgage industry leaders that the new nationwide loan limits for conventional loans would be $625,000 throughout most of the country and most of Colorado. At that time it was believed that the high cost states and counties would have loan limits as high as $937,500 which is 1.5 times higher than the normal conventional limit.

However, FHFA surprised the industry by announcing an even higher conventional loan limit for most of the country (including Colorado).

So, What is the Final Conventionl (aka Conforming) Loan Limit in Colorado for 2022?

The final number in terms of the 2022 loan limits in Colorado is $647,200. Therefore the high cost states of Alaska and Hawaii will have a loan limit set at 1.5 times the normal conventional loan limit. Hence, the high cost states will have conventional loan limits set at $970,800.

How Many Counties Have Higher Conventional Loan Limits in Colorado

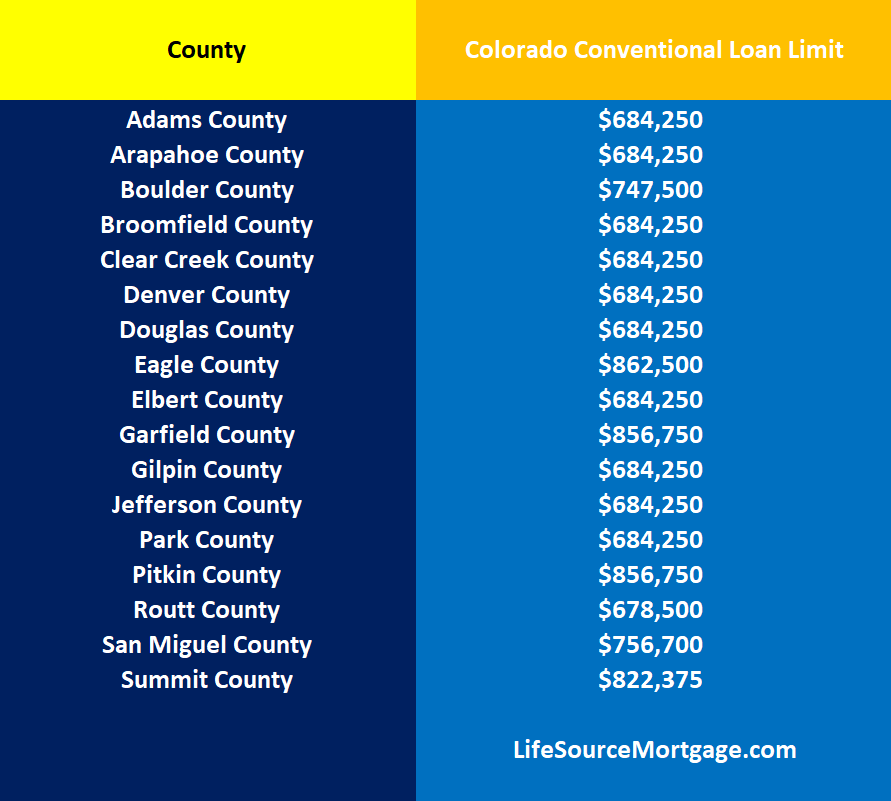

The nation’s housing market has just been on fire in much of the country and the same is true in Colorado. There are 17 counties in Colorado that will have higher loan limits above the $647,200 mark. Below you’ll find a chart that show the 17 counties with higher loan limits in Colorado along with their respective loan limit. Any counties not on the chart have a loan limit set at $647,200.

Contact LifeSource Mortgage Today

What Are the Benefits of Having Higher Conventional Loan Limits in 2022?

- PIW – Many Colorado homeowners can potentially be eligible for an appraisal waiver, aka PIW (Property Inspection Waiver). When loan officers first get your loan approved, it’s done with electronic underwriting via Freddie Mac and Fannie Mae’s Loan Prospector and Desktop Underwriter software. The software reads all the variables and tells us if the property is eligible for a PIW. Loans that are eligible for PIW’s can close a tad bit quicker and of course the homeowner doesn’t need to incur the cost of the appraisal.

- 1 year of tax returns for self employed borrowers. Sometimes self employed borrowers can get approved with just one year’s worth of tax returns vs the customary two years worth of tax returns.

- Limited Homeowner’s Association Certificates for condominiums. This reduces the amount of info that lenders will request from your Home Owner’s Association. , This saves homeowners in Colorado both time and money.

- Interest rates are typically lower for conventional loans than they are for jumbo loan. This translates into lower payments and more buying power.

- Conventional loans tend to have higher debt to income caps than jumbo loans. Jumbo loans tend to cap the DTI at about 43%. Conventional loan applicants can obtain approvals with DTI ratios as high as 50%. Again, this translates into more buying power vs a jumbo loan.

- Conventional loans also requite less money in reserves vs jumbo loans – the lenders don’t need to see as much money in the bank, giving borrowers flexibility and an ability to purchase a more expensive home

Want more info on any kind of loan in Colorado, contact us today at [email protected] or (949) 492-2252 x704

Conventional Loan Limits for the Rest of Colorado

| County Name | 1-Unit | 2-Units | 3-Units | 4-Units |

| ADAMS | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| ALAMOSA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| ARAPAHOE | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| ARCHULETA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| BACA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| BENT | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| BOULDER | $747,500 | $956,950 | $1,156,700 | $1,437,500 |

| BROOMFIELD | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| CHAFFEE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| CHEYENNE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| CLEAR CREEK | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| CONEJOS | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| COSTILLA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| CROWLEY | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| CUSTER | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| DELTA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| DENVER | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| DOLORES | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| DOUGLAS | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| EAGLE | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| ELBERT | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| EL PASO | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| FREMONT | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| GARFIELD | $856,750 | $1,096,800 | $1,325,800 | $1,647,650 |

| GILPIN | $647,200 | $875,950 | $1,058,850 | $1,315,900 |

| GRAND | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| GUNNISON | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| HINSDALE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| HUERFANO | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| JACKSON | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| JEFFERSON | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| KIOWA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| KIT CARSON | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| LAKE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| LA PLATA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| LARIMER | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| LAS ANIMAS | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| LINCOLN | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| LOGAN | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| MESA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| MINERAL | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| MOFFAT | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| MONTEZUMA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| MONTROSE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| MORGAN | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| OTERO | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| OURAY | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| PARK | $684,250 | $875,950 | $1,058,850 | $1,315,900 |

| PHILLIPS | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| PITKIN | $856,750 | $1,096,800 | $1,325,800 | $1,647,650 |

| PROWERS | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| PUEBLO | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| RIO BLANCO | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| RIO GRANDE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| ROUTT | $678,500 | $868,600 | $1,049,950 | $1,304,850 |

| SAGUACHE | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| SAN JUAN | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| SAN MIGUEL | $756,700 | $968,700 | $1,170,950 | $1,455,200 |

| SEDGWICK | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| SUMMIT | $822,375 | $1,053,000 | $1,272,750 | $1,581,750 |

| TELLER | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| WASHINGTON | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| WELD | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| YUMA | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

Contact LifeSource Mortgage Today

All rights reserved, LifeSource Mortgage, California’s best mortgage broker today to explore your mortgage options!